To know more about the scheme, checkout the video interview of the fund manager.

Business cycles arise as the economy goes through a series of stages as it expands and contracts. This characterised by downward or upward fluctuations of GDP. Business cycle has four phases: Recession, Recovery, Expansion and Slowdown. Each phase in the business cycle presents unique investment opportunities. So, incorporating business cycles theme into investments helps make the most of the current economic environment.

Tata Business Cycle Fund aims to deploy the business cycle approach to investing to identify economic trends and invest in sectors and stocks that are likely to outperform

Business cycles arise as the economy goes through a series of stages as it expands and contracts. This characterised by downward or upward fluctuations of GDP. Business cycle has four phases: Recession, Recovery, Expansion and Slowdown. Each phase in the business cycle presents unique investment opportunities. So, incorporating business cycles theme into investments helps make the most of the current economic environment.

Tata Business Cycle Fund aims to deploy the business cycle approach to investing to identify economic trends and invest in sectors and stocks that are likely to outperform

To know more about the scheme, checkout the video interview of the fund manager - Rahul Singh, CIO - Equities at Tata MF

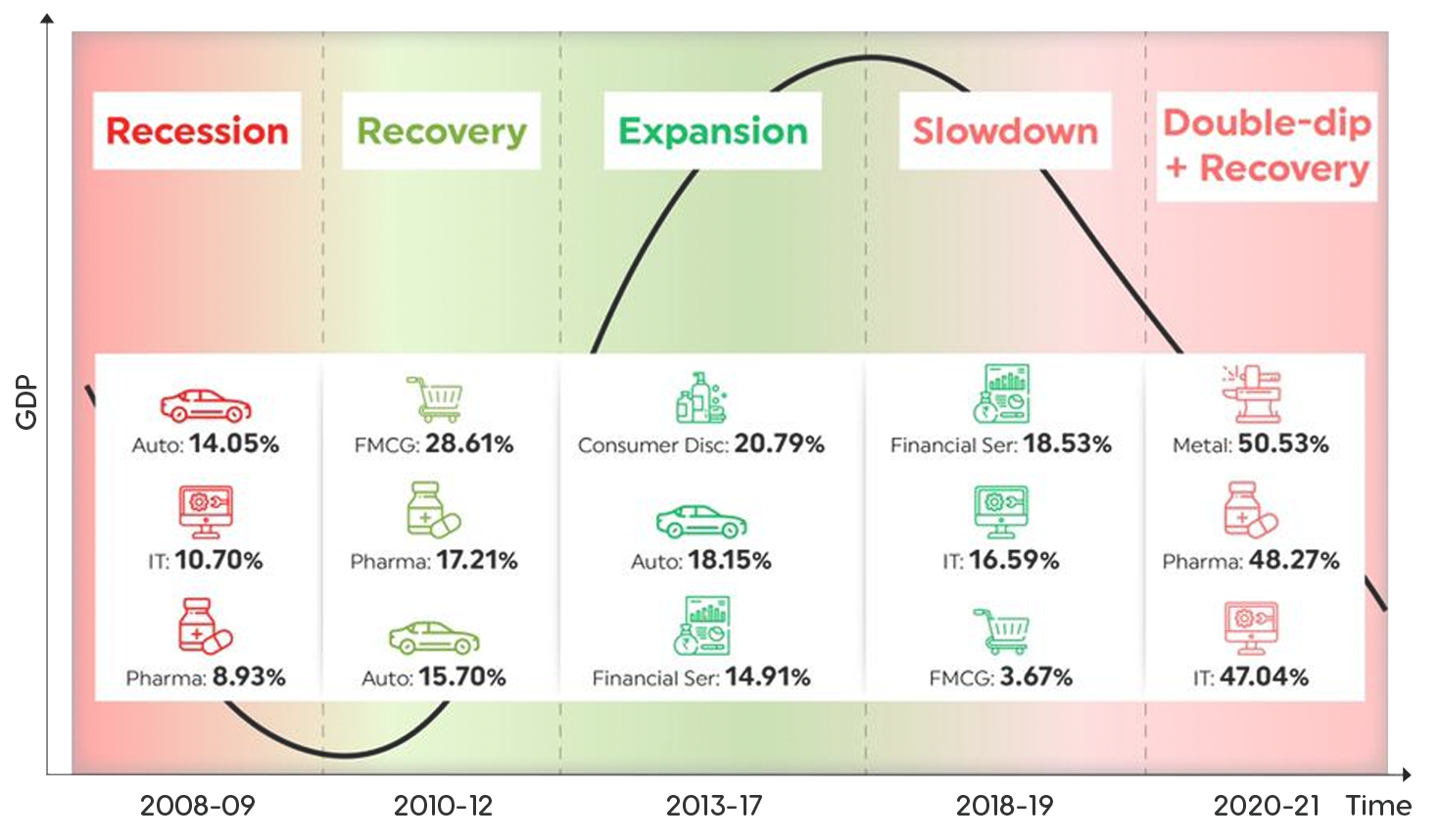

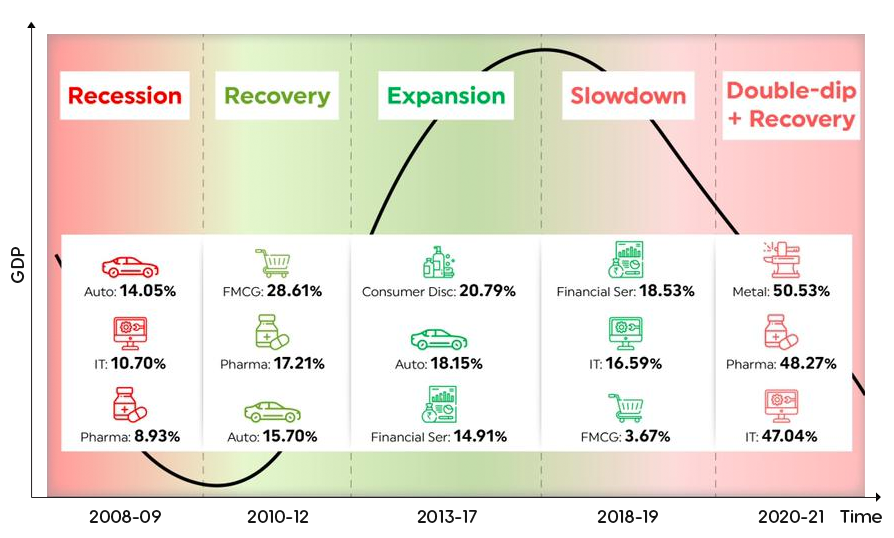

Sectoral Performance

Source: MFI, Indices: Nifty Financial Services, Nifty IT, Nifty Pharma, S&P BSE AUTO, S&P BSE CG, S&P BSE Consumer Disc Goods & Services, S&P BSE FMCG, S&P BSE Industrials, S&P BSE METAL, S&P BSE Realty, S&P BSE Utilities. Phases classified on the basis of alignment of economic indicators(Inflation, Interest Rate, Capacity Utilisation, GDP Annual Growth Rate) with theoretically expected trends in business cycles phases

Make most of the unique investment opportunities presented by the different phases of the economic cycle by investing in Cyclicals during Expansion and Defensives during Contraction

The business cycle theme allows the fund to consider aggressive sector over/under weight calls as compared to other diversified funds across different economic phases

Business Cycle are getting shorter which earlier lasted 4-5 years have now shortened to 1-2 years. Hence active top-down sector and stocks ration is key to Alpha generation across every phase

Portfolio parameters like portfolio churn, market cap allocation, number of stocks in portfolio too will be based on the stage of the business cycle.

Fund would invest atleast 80% of the portfolio as per Business Cycles theme and rest in other equities, debt instruments, Gold ETF, REITs & InvITs.

With the duration of business cycles shortened, the need for a fund that changes with change in cycle has arisen

A fund that adapt to changes is needed because:

Markets are at fair valuations Because of global and domestic uncertainties on account of policies as well as event, Top down approach of investment at current juncture may help to navigate better investment opportunity.

Over the last few years, the impact of sector allocations has been greater on alpha generation versus stock level allocations.

Investors seeking diversified portfolio which adapt quickly to the changing environment and change sectoral exposure based on the business cycles.

Investors looking for top down investment style to investing

Investors seeking differentiated portfolio with greater sector concentration in terms of sector over/underweight as compared to diversified funds

| Scheme Name | TATA BUSINESS CYCLE FUND |

| Investment Objective | To generate long-term capital appreciation by investing with focus on riding business cycles through allocation between sectors and stocks at different stages of business cycles. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Type of Scheme | An open-ended equity scheme following business cycles based investing theme. |

| Fund Manager | Rahul Singh (Fund Manager), Sailesh Jain (Assistant Fund Manager), Venkat Samala (Overseas Investment) and Murthy Nagarajan (Debt Portfolio) |

| Benchmark | Nifty 500 TRI |

| Min. Investment Amount | Minimum subscription amount: Rs 5,000/- and in multiple of Re.1/- thereafter. Additional Purchase: Rs.1000/-& in multiples of Re.1/-thereafter. |

| Load Structure | Entry Load: Nil. Exit Load:

|

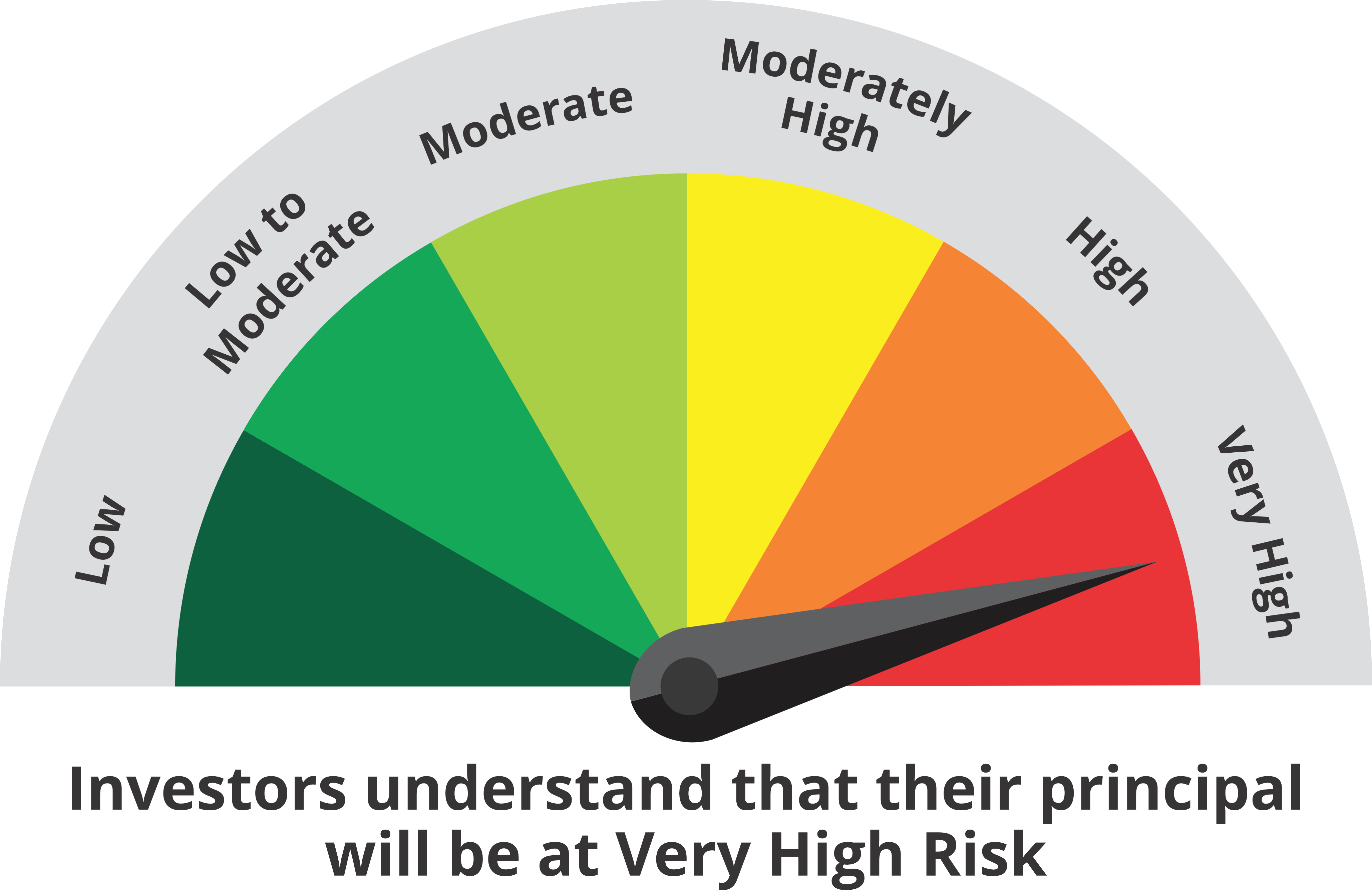

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051